Features

Ethnocultural Vegetables in Canada Part I

Resource Guides

Sales Analysis

October 6, 2016 By Fruit & Vegetable

The sales of vegetables within Canada remain relatively constant year round. As a commodity item they are demanded regardless of seasonality for people’s health and wellbeing. An issue that Canada has with the production of ethnocultural vegetables is the dependence on warm weather for growth. Growing seasons vary slightly among different products; however June until November is the best time for outdoor production (Foodland Ontario, 2010). This leads to an issue of year round supply which may be resolved by cold storage of vegetables in green houses. Greenhouses, however, increase the price of the good due to their costly capital investment and constant use of manual labour (Smith, 2011). In order to get unrestrictred access to fresh ethnocultural vegetables some imports may need to be used to supplement the winter supply.

With the ability for yearlong supply farmers would be able to feed the domestic market with fresh local vegetables. Golden Grocers, a small independent grocery retailer located in the GTA was able to give data on the weekly sales of their cultural produce (Singh, 2011). These forecasts are rough estimates that provide a good example of the yearly demand for cultural vegetables. All products that are currently being sold by this grocer are imported, however they stressed their willingness to purchase domestically should the opportunity arise (Singh, 2011).

| Vegetable | Weekly (lb) | Monthly (lb) Estimate | Yearly (lb) Estimate |

| Roun/Indian Eggplant |

30 Advertisement

|

130 | 1560 |

| Indian Bitter Melon | 30 | 130 | 1560 |

| Long Squash | 45 | 195 | 2340 |

| Okra | 15 | 65 | 780 |

|

Tindora |

20 | 87 | 1040 |

| Chinese Long Eggplant | 30 | 130 | 1560 |

| Long Chilli | 30 | 130 | 1560 |

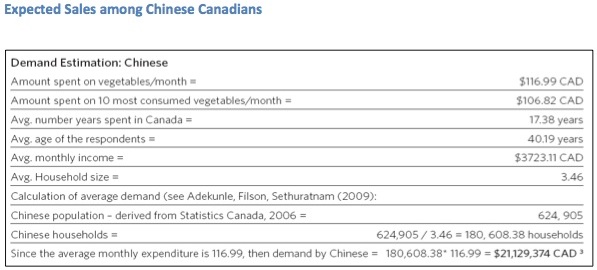

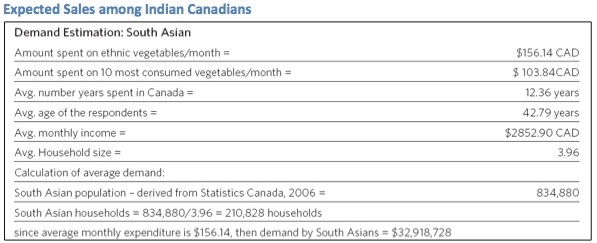

Vegetable Chart on Page 10 This demand can also be broken down and investigated in regards to the individual consumption among each respective social group. Below are Chinese and Indian population statistics which are used to estimate individual consumption rates as well as the market value presented by both.

|

|

|

Research done by Dr. Glen Filson, Dr. Adekunle, and Sridharan Sethuratnam investigated the consumption habits of the average Chinese Canadian to establish an expected market value. The figure above displays the potential value of growing ethnocultural vegetables within Ontario with respect to Chinese Canadians. Producing 10 of the most popular vegetables would equate to an expenditure of roughly $106.82 dollars per household (Filson, Adekunle, & Sethuratnam, 2011). With an average of 3.46 people per household they were able to determine that there were just over 180.6 thousand Chinese Canadian Households. This gave them the final expenditure by Chinese Canadians of $21,129,478 dollars.

|

|

|

The same study was done for Indian customers and discoverded that they provided an even larger potential market. While average incomes for South Asian consumers are below that of Chinese Canadians, $2,852.90 and $3,723.11 respectively. Their average expenditure on vegetables is actually higer at $156.14 CAD. With an average 3.96 people per household it was found that they had a total value of $32,918,728 (Filson, Adekunle, & Sethuratnam, 2011). The results of these analyses are a clear indication of large market opportunity for farmers.

Print this page